Applications for Bounce Back Loans are open as of this morning (Monday), in a bid to help more small businesses navigate the coronavirus crisis. Thousands of small firms and sole traders - including hairdressers, coffee shops and florists will be eligible and can apply online, with seven questions to answer. The scheme offers loans via banks of between £2,000 to £50,000 and is 100% guaranteed by the government. Banks handling the loans will not be required to run credit checks or assess the long-term viability of applicants. The money is interest and payment-free for the first year - with rates of 2.5% per annum after the first 12 months. The Chancellor of the Exchequer, Rishi Sunak, said: "Small businesses will play a key role creating jobs and securing economic growth as we recover from the Coronavirus pandemic.

"The Bounce Back loan scheme will make sure they get the finance they need - helping them bounce back and protect jobs."

Business Secretary Alok Sharma said: "We are backing small businesses, which are the backbone of our communities, with the support they need to stay afloat."This new scheme of 100% government-guaranteed loans gives owners of even the smallest businesses the confidence and flexibility to borrow a sum which works for them. This will help ensure they can continue"

Mike Cherry, National Chair of the Federation of Small Businesses, said: “We know many small firms have struggled to secure small loans speedily. We are pleased that the Chancellor has listened, and swiftly developed this new scheme for small businesses to access finance quickly, interest-free for the first year and at an affordable fixed interest rate for the remainder.”Find more about the loan via the Gov.uk website here

Apply for the loan here.

New Dementia Hub To Open In Cowes Next Week

New Dementia Hub To Open In Cowes Next Week

Armed Forces Covenant Members Supporting Armed Forces Day

Armed Forces Covenant Members Supporting Armed Forces Day

Miriam Margolyes, Aggers And Tuffers And Plastic Mermaids To Headline Wight Proms 2024

Miriam Margolyes, Aggers And Tuffers And Plastic Mermaids To Headline Wight Proms 2024

Isle Of Wight Shoppers Helping To Tackle Rising Levels Of Hygiene Poverty

Isle Of Wight Shoppers Helping To Tackle Rising Levels Of Hygiene Poverty

Two Isle Of Wight Businesses Win At Annual Muddy Stiletto Awards

Two Isle Of Wight Businesses Win At Annual Muddy Stiletto Awards

Sandown Carnival Launches 2024 Season

Sandown Carnival Launches 2024 Season

Dover Park Primary School Celebrates Continued Success With Glowing Ofsted Report

Dover Park Primary School Celebrates Continued Success With Glowing Ofsted Report

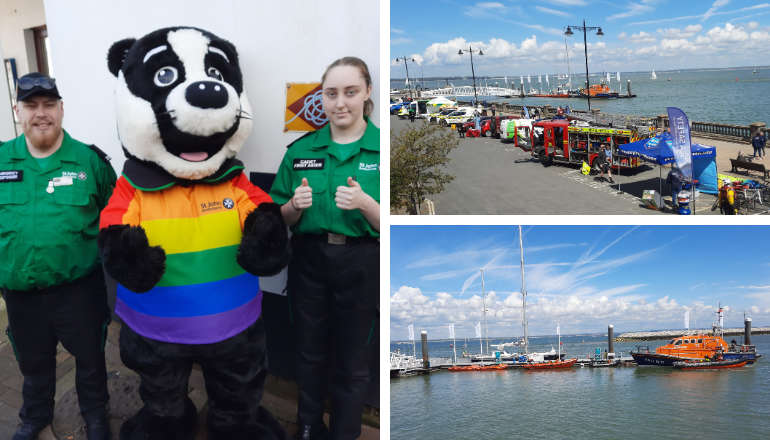

Rescue Services Join RNLI’s 200th Celebration Event At Cowes

Rescue Services Join RNLI’s 200th Celebration Event At Cowes

Isle Of Wight Council To Move To Committee System In 2025

Isle Of Wight Council To Move To Committee System In 2025

Highway Improvement At Church Litten Next Week

Highway Improvement At Church Litten Next Week

Isle Of Wight Beaches Praised In Clean Water League Table

Isle Of Wight Beaches Praised In Clean Water League Table

Man Arrested After Being Caught During Act Of Self-Gratification In Newport

Man Arrested After Being Caught During Act Of Self-Gratification In Newport

May Day Bank Holiday Recycling And Waste Collection Information

May Day Bank Holiday Recycling And Waste Collection Information

Isle Of Wight Ambulance Service Star Louise Awarded King’s Ambulance Medal

Isle Of Wight Ambulance Service Star Louise Awarded King’s Ambulance Medal

Stranded RIB Towed To Safety By Cowes Lifeboat

Stranded RIB Towed To Safety By Cowes Lifeboat

Major Highway Works Taking Place Across Isle Of Wight This Month

Major Highway Works Taking Place Across Isle Of Wight This Month

Three Men Arrested On Suspicion Of 'Attempting To Take Child'

Three Men Arrested On Suspicion Of 'Attempting To Take Child'

Wildheart Animal Sanctuary Rescue To Bring First Bears To Isle Of Wight For 30 Years

Wildheart Animal Sanctuary Rescue To Bring First Bears To Isle Of Wight For 30 Years

One Week To Go Until Isle Of Wight Walking Festival 25th Anniversary

One Week To Go Until Isle Of Wight Walking Festival 25th Anniversary

Apply Now For Grant Funding To Help Strengthen Family Support On Isle Of Wight

Apply Now For Grant Funding To Help Strengthen Family Support On Isle Of Wight