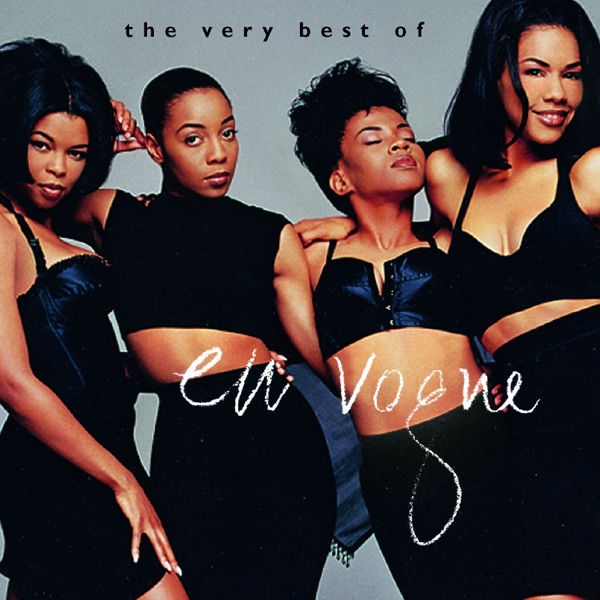

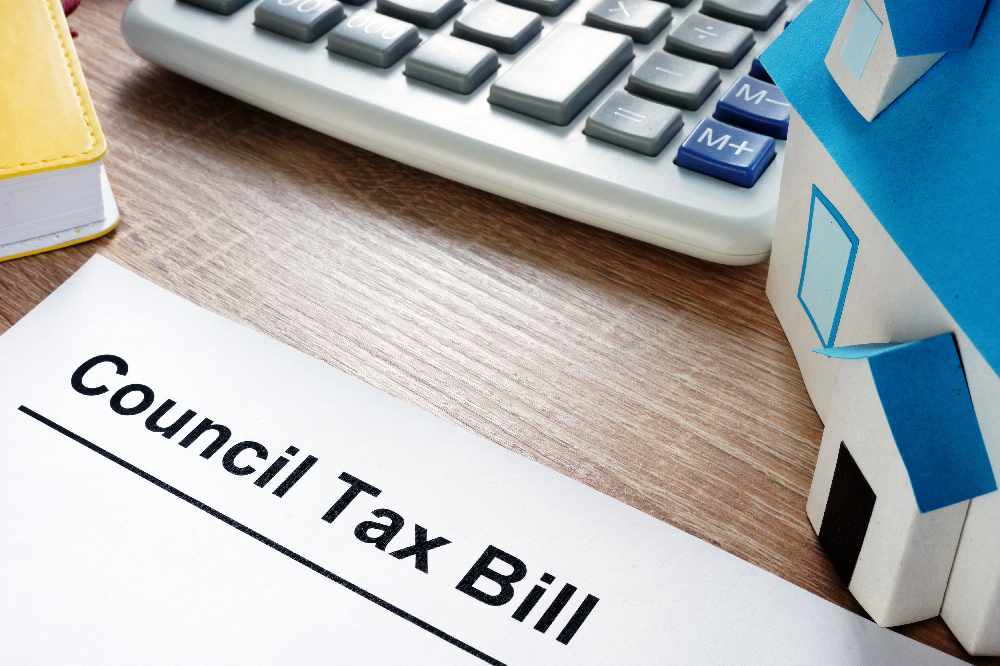

The Isle of Wight Council is consulting on whether to change the level of Local Council Tax Support Islanders receive.

Among the options include decreasing or increasing help. Islanders are being asked to fill out the annual survey over the next two months.

Currently, there are more than 5,000 Isle of Wight residents on lower incomes who use the scheme.

The implications of changes to the scheme could affect both recipients of local council tax support as well as users of council services more widely and therefore will be open to all residents to participate.

The results of the survey form part of the decision-making process for setting council tax and the overall council budget next year.

The main options included in the consultation include:

- keeping the level of support as it is at 65%;

- increasing the top level of support from 65% to 70%;

- increasing the level of earnings disregard from £25 to £30 per week;

- reducing the amount of support offered to low-income groups.

Another new option in the consultation is to consider whether to decrease the non-dependant deduction from £2 to £1 a week. The council said this would help claimants who have other adults living with them by over £50 a year.

Each of the options has a significant impact on the council budget. Higher levels of relief would require savings and cuts elsewhere. Lower levels of relief could lead to an increase in council tax arrears and lower levels of Council Tax collection, the council claims.

Councillor Chris Jarman, Cabinet member for Strategic Finances said:

“Nearly 4% of Islanders presently receive Local Council Tax Support. The cost-of-living crisis is having a profound impact on residents on lower incomes. The forecast is for this to continue and indeed become more severe due to further rises in utility costs.

“The council needs to ensure that it has a balanced budget and to cover its statutory responsibilities, it must also be mindful of the impact of Council Tax on already stretched household budgets.

“It is important that all Islanders have the opportunity to comment on the options as we start to make difficult decisions about council finances for 2023-4.”

Any changes will relate to working age residents only. Those of pension age will not be affected.

Link to the consultation: https://www.iow.gov.uk/

Four Men Arrested Following Rogue Trader Activities In East Cowes

Four Men Arrested Following Rogue Trader Activities In East Cowes

Rugby Players Set To Scale Great Heights For Teddy

Rugby Players Set To Scale Great Heights For Teddy

Drug Driving, Domestic Abuse And Stalking Among Arrests Made As Police Target Isle Of Wight Criminals

Drug Driving, Domestic Abuse And Stalking Among Arrests Made As Police Target Isle Of Wight Criminals

Work Begins On ‘Monumental’ Mural Project At Historic Columbine Building

Work Begins On ‘Monumental’ Mural Project At Historic Columbine Building

More Acts Added To Isle Of Wight Festival Line-Up

More Acts Added To Isle Of Wight Festival Line-Up

St Mary’s Vaccination Hub Gets Ready For Spring Covid-19 Vaccinations

St Mary’s Vaccination Hub Gets Ready For Spring Covid-19 Vaccinations

Twenty Isle Of Wight Pubs Under Threat As Stonegate Issues Profit Warning

Twenty Isle Of Wight Pubs Under Threat As Stonegate Issues Profit Warning

Fundraiser Launched As Kezi's Kindness Founder Diagnosed With Incurable Cancer

Fundraiser Launched As Kezi's Kindness Founder Diagnosed With Incurable Cancer

Bon Voyage — White-Tailed Eagle Soars To France

Bon Voyage — White-Tailed Eagle Soars To France

Goddards Brewery Scoops Four Top Industry Awards At International Competition

Goddards Brewery Scoops Four Top Industry Awards At International Competition

Briddlesford Road Crash Results In Two Injured

Briddlesford Road Crash Results In Two Injured

Isle Of Wight MP Extolls Virtues Of Joint Emergency Service Officers For Isle Of Wight

Isle Of Wight MP Extolls Virtues Of Joint Emergency Service Officers For Isle Of Wight

Island Labour Announces Parliamentary Candidates As Quigley Vows To 'Take Fight' To Bob Seely

Island Labour Announces Parliamentary Candidates As Quigley Vows To 'Take Fight' To Bob Seely

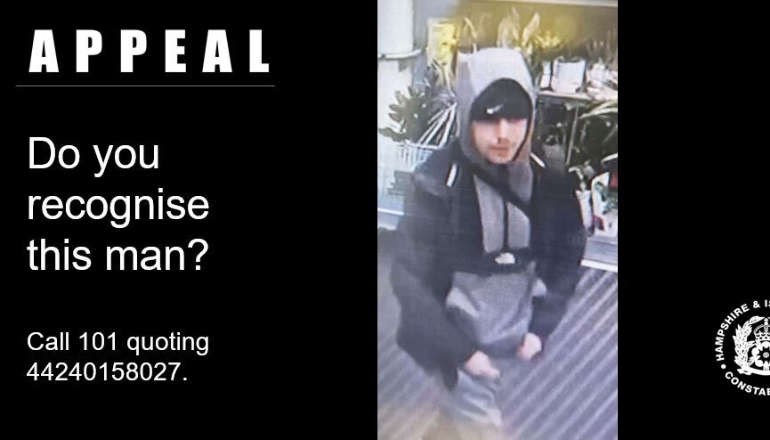

Can You Help Police To Identify Man Linked To Waitrose Theft?

Can You Help Police To Identify Man Linked To Waitrose Theft?

Ryde Town Council In Crackdown On Dog Fouling

Ryde Town Council In Crackdown On Dog Fouling

Former Patient Opens New Intensive Care Unit

Former Patient Opens New Intensive Care Unit

Isle Of Wight Primary School Place Allocations Announced For September

Isle Of Wight Primary School Place Allocations Announced For September

The Rules Islanders Need To Know For Police And Crime Commissioner Election Postal Voting

The Rules Islanders Need To Know For Police And Crime Commissioner Election Postal Voting

Family Pays Tribute To Paul Hart Following Fatal Newport Collision

Family Pays Tribute To Paul Hart Following Fatal Newport Collision

Teenager Sentenced For Planning Isle Of Wight Festival Terrorist Attack

Teenager Sentenced For Planning Isle Of Wight Festival Terrorist Attack